On August 27 and August 31, 2021, FiinRatings has successfully organized two Webinars on Rating Rationales on Bamboo Capital JSC (“BCG”) and Vietnam Renewable Energy Outlook with the participation of industry experts and hundreds of investors, institutions, and organizations both domestically and internationally.

Please kindly take a look at highlights of the conference:

Ratings Rationales on Bamboo Capital Group (“BCG”)

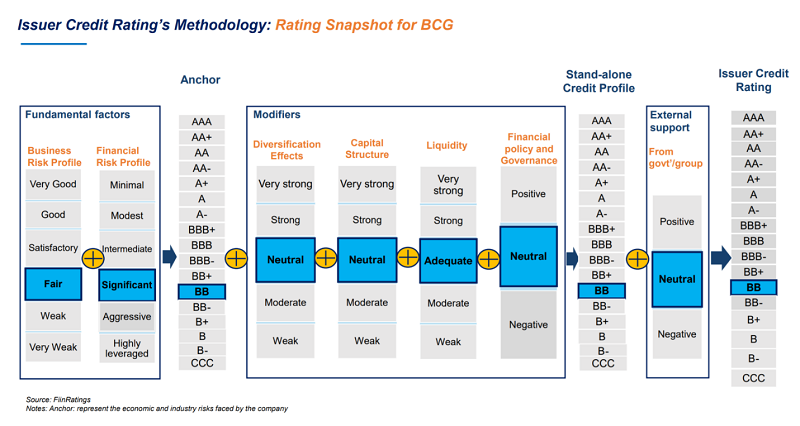

After affirming Bamboo Capital Joint Stock Company (“BCG”) at BB; Outlook: Positive, Mr. Le Hong Khang, Lead Analyst of FiinRatings, shared some Credit Highlights and main rating drivers of BCG Rating Result.

Accordingly, BCG's rating result has reflected its operational footprint and difficulties, especially in the context of COVID-19. FiinRatings' positive outlook for BCG reflects an emerging developer in medium and long-term growth prospect in the renewable energy and properties development sectors. The positive outlook also reflects FiinRatings' expectation that the Company's financial flexibility will improve as renewable energy projects and real estate projects begin to bring in stable cash flows from 2021 and through the Company's plans to increase equity. Additionally, Mr. Khang also shared the Upside and Downside Scenarios of BCG.

Gaining much attention from investors, the representative of FiinRatings also introduced the Issuer Credit Rating’s Methodology: Rating Snapshot for BCG.

Methodology and Criteria; The Use of our Rating Results

In this section, Ms. Prachi Gupta, MMS – Financial Advisor of FiinRatings (former Director cum member of Credit Ratings Committee at CRISIL) presented the methodology and rating criteria of FiinRatings, and presented comparisons with international credit rating agencies.

FiinRatings has specific differences compared to other companies in the same industry in the world. The set of credit rating criteria has been refined to suit the particular business environment in Vietnam. FiinRatings provides a rating scale that differentiates between issuers/issuers in Vietnam using the highest rating of the Vietnamese government (AAA) as the benchmark.

Besides, Ms. Prachi also denoted the significant role of the Rating results to the safety level of debt obligations and credit risk; and analysis of the default rate corresponding to the rating scale monitored by different international CRAs, such as S&P, CRISIL or Tris Rating.

The significant role of a domestic CRA to issuers, investors, and other stakeholders:

Credit Ratings supplement Issuers/Borrowers:

- To optimize the cost of funding.

- To reach a broader number of issuers.

- To extend the terms of financing.

- To diversify sources of funding.

Credit Ratings helps to provide a multi-dimensional perspective to Investors:

- To issue independent assessments of the Debt servicing capacity of issuers.

- To provide comparable analysis across type of instruments or industries and peers.

- To bring informative metrics to support investors making informed decisions.

Vietnam Renewable Energy Outlook

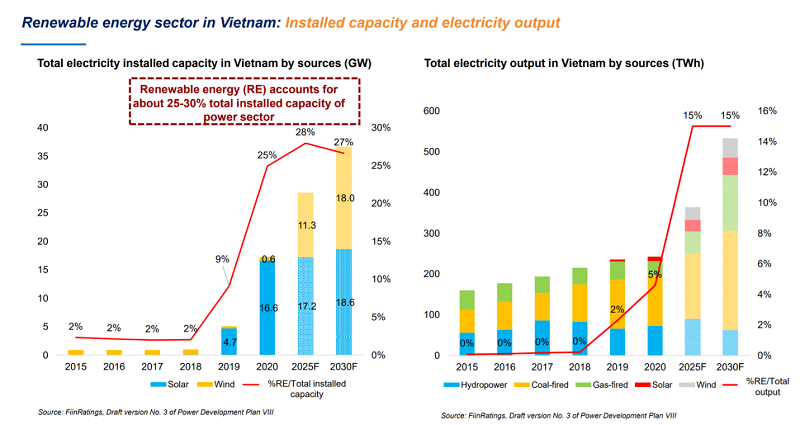

Mr. Le Xuan Dong - Member of FiinRatings Rating Committee, Head of FiinResearch, FiinGroup gave an overview of the electricity industry and renewable energy sources in Vietnam.

According to Mr. Dong, in the short term, the Vietnamese renewable energy sector would face several challenges, including a new mechanism of purchasing power price for wind and solar power after October 31, 2021; several issues affecting the safe and smooth operations of the national power grid system due to the installed capacity of solar and wind power projects; as well as the complicated and prolonged COVID-19 pandemic.

However, in the medium and long term, the renewable energy sector would enjoyed positive prospects as electricity demand in Vietnam is forecasted to continue its high growth rate (around 8%-9% per year) thanks to the solid economic growth, especially in the post-pandemic period, as well as the increasing consumption demands of the residential segments.

Kindly refer to the detail presentation document here:

VIETNAMESE

ENGLISH